|

On revenues of

13.7 billion in the first quarter of 2007, up 8.9% from

2006, Fiat Group posted the 9th consecutive quarterly

year-over-year improvement in trading profit (IFRS based),

up 84% to 595 million. All major businesses contributed to

the improvement: the Automobiles businesses result more than

quadrupled to 222 million (173 million better than 2006),

Iveco (trucks) more than doubled its performance, up 80

million to 150 million, while the Agricultural and

Construction Equipment business improved 52 million to 189

million (+50% in US dollar terms). Net income at 376

million is 225 million or 149% better than the prior year.

Net industrial debt dipped below 1.3 billion, a

0.5 billion improvement over December 2006 levels. Group

targets are confirmed for 2007, with year-end net industrial

debt now foreseen below 1 billion.

The Board of Directors of Fiat S.p.A. met today in Turin

under the chairmanship of Luca Cordero di Montezemolo to

approve the consolidated results of the Group for the first

quarter 2007.

Group revenues rose 8.9% to 13.7 billion, with all

businesses up on the prior year: the main drivers of this

growth were Automobiles, which increased by 11.2% to 6.8

billion and Trucks, which achieved a 20.1% increase to 2.5

billion:

Continued success of recently launched and established

models enabled Fiat Group Automobiles to sell 541,200 units,

its highest level since 2001.

Iveco benefited from strong trading conditions in Western

Europe and improved performances in Eastern Europe and Latin

America, with volumes reaching the highest first quarter

level in its trading history.

Agricultural and Construction equipment (CNH) revenues

were up 10.6% in US dollar terms (1.5% reported).

Trading profit rose to 595 million (+84%) with all major

Sectors showing gains:

Automobiles trading profit rose 173 million to 222

million, on the back of a marked improvement by Fiat Group

Automobiles which posted a trading profit of 192 million

(3.1% of revenues) from 57 million (1% of revenues).

Iveco posted its best ever first quarter trading profit,

at 150 million from 70 million, with margins moving to 6%

from 3.4%.

Agricultural and Construction Equipment business improved

by 50% in US dollar terms to 189 million (7% on sales),

driven by strong sales and market share gains in key

portions of the agricultural markets, and strong performance

of Construction equipment outside the US.

Components & Production systems were nearly unchanged, but

up 21 million excluding

Comau.

Net industrial debt was reduced by nearly 500 million from

year-end levels to 1,277 million, driven by positive

operating performance and disposal of non-core assets.

All sectors confirm 2007 objectives, with Group net

industrial debt levels expected to dip below 1 billion by

year-end (without considering the impact of share

buy-backs).

The Group

Fiat Group had revenues of 13.7 billion in Q1 2007, up 8.9%

from the same period in 2006. The improvement was largely

attributable to the Automobiles and Trucks businesses. With

revenues of 6.8 billion, the Automobiles businesses grew by

11.2% from Q1 2006. All sectors contributed to this positive

performance: with revenues of 6.3 billion, Fiat Group

Automobiles grew by 10.2%; Ferrari and Maserati also posted

large year-over-year improvement. Iveco (trucks) had

revenues of 2.5 billion, an increase of 20.1% due to a

sharp increase in sales volumes and improved pricing.

Agricultural and Construction Equipment businesses had

revenues of 2.7 billion (+1.5% reported, +10.6% in US

dollar terms), driven by improved mix and better pricing.

Revenues in the Components and Production Systems businesses

totalled 3.2 billion. The slight increase (+1.2% from Q1

2006) reflects diverging performances in the various

sectors. Revenues increased by 8.2% at Fiat Powertrain

Technologies. At Magneti Marelli, revenues increased by 2.7%

(7.4% on a scope-comparable basis). On the other hand,

revenues were down 10% on a comparable basis at Teksid (weak

US markets) and 25.2% at Comau (structural decline in the

industrys investment levels).

Trading profit totalled 595 million, 84% better than Q1

2006, with margins moving to 4.4% from 2.6%. The

contribution of the Automobiles businesses was key in

achieving this improvement: in particular, trading profit at

Fiat Group Automobiles grew by 135 million to 192 million,

resulting in a trading margin of 3.1% (1.0% in Q1 2006).

Ivecos trading profit increased by 114% to 150 million,

with margins of 6.0% (3.4% in Q1 2006). Agricultural and

Construction Equipment (CNH) trading profit also increased

significantly to 189 million (+ 52 million in reported

terms, 50% higher in US dollars), equal to 7% of revenues.

In the Components and Production Systems businesses, the

improvements reported by Fiat Powertrain Technologies,

Magneti Marelli and Teksid were offset by losses at Comau, a

business currently undergoing a restructuring process

started in the last part of 2006. Excluding the impact of

Comau, the trading profit of these businesses increased by

21 million. In Q1 2007, Fiat Group achieved an operating

income of 595 million, with unusual items netting out to

nil.

In Q1 2007 net financial expenses totalled 57 million (135

million in 2006) which includes the positive contribution of

a 91 million (33 million in Q1 2006) gain on two

stock-options related equity swaps. Income before taxes

totalled 574 million, two and half times 2006 levels of

232 million. The 342 million improvement is due in the

main to the increase of 272 million in operating results,

as well as to lower net financial expenses for 78 million.

Net income before minority interest for the first quarter of

2007 was 376 million, compared with 151 million in the

same period of 2006. The Group generated net industrial cash

flow (change in net industrial debt excluding capital

contributions, dividends paid and foreign exchange

translation differences) of approximately 0.5 billion,

reflecting positive business performance and proceeds from

the disposal of non-core businesses. Net industrial debt

consequently decreased by approximately 0.5 billion to 1.3

billion. The Groups cash position at March 31, 2007 was

approximately 7.6 billion (8.0 billion at the end of

2006).

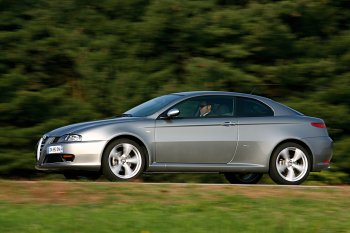

Automobiles

The Automobiles businesses posted revenues of 6.8 billion

in Q1 2007, up 11.2% from the same period in 2006 due to the

sharp increase in sales volumes. Fiat Group Automobiles,

which adopted its new name on February 1, 2007, and

comprises the Fiat, Alfa Romeo, Lancia and Fiat Professional

brands, had revenues of 6.3 billion, up 10.2% from Q1 2006.

With 541,200 units sold, volumes of Fiat Group Automobiles

increased by 11.6%, although Q1 2006 already reflected the

impact of the launch of the Grande Punto while Q1 2007 does

not yet reflect the market impact of the introduction of the

new C-segment Fiat vehicle (Bravo).

Approximately 355,600 units were sold in Western Europe, an

increase of 6.7%. Fiat Panda retained its leadership

position in the A segment and Punto was one of the

bestselling models in its segment. Orders for the Fiat

Bravo, which went on sale in Italy in February and in March

in France, had topped 29,000 units and 11,000 units sold in

the quarter.

The Western European automobile market contracted by 1.1%

from Q1 2006. This performance was impacted by the sharp

contraction in German demand (-10%), and to a lesser extent

in France (-1.4%) and Spain (-0.7%), offset by growth in

Italy (+4.1%) and the UK (+2.9%). Demand rose by 24.5% in

Poland and 17.4% in Brazil. Deliveries of Fiat Group

Automobiles remained at high levels, outperforming the

markets in all key European countries. Volumes rose by 8.2%

in Italy, 19.4% in Spain, 13.4% in France, and 8.3% in Great

Britain. In Germany, deliveries dropped by 3.9%, much less

than the market decline. The market share of Fiat Group

Automobiles continued to grow, reaching 31.8% in Italy (+1.2

percentage points) and 8.5% in Western Europe (+0.5

percentage point), where it reacquired 5th spot in the

rankings of European car producers, a position it last held

in 2001. Deliveries rose by 25.1% in Brazil compared with Q1

2006, reaching a market share of 24.8% (+1.1 percentage

points). Deliveries in Poland increased by 1.4%, and market

share rose by 0.6 percentage points to 10.9%. A total of

94,100 light commercial vehicles were delivered, an increase

of 28.5% from Q1 2006. In Western Europe, while demand rose

by 3.9%, Fiat Light Commercial Vehicles deliveries increased

21.3% to 59,400 units. The Groups LCV market share was

10.6% in Western Europe (+0.6 percentage point) and 42.0% in

Italy, unchanged with respect Q1 2006.

Fiat Group Automobiles had a trading profit of 192 million

in Q1 2007 a significant improvement from the 57 million

reported in Q1 2006. The increase is mainly attributable to

higher volumes, a more favourable product mix following the

introduction of new models, more efficient absorption of

fixed production costs, net of higher advertising costs for

the launch of new models and increased R&D expenses

reflecting recent investments in the rejuvenation of the

product portfolio. Trading profit was also positively

impacted by a one-off gain net of one-off costs of

approximately 40 million.

In Q1 2007, Fiat strengthened its presence in the most

important market segment (C) in Europe with the launch of

the Bravo which has received a good level of acceptance. The

Bravo was the first model to sport the Fiat brands new

logo, while the Lancia brand also introduced a new corporate

identity. Highlights of the Geneva Auto Show included the

relaunch of the historic Abarth brand by Fiat. Alfa Romeo

introduced a diesel version of the Alfa Spider (first diesel

fuelled model in the segment), which has been available in

Italy and Germany since mid-February and will be gradually

launched in other countries. Maserati had revenues of 167

million in Q1 2007, up 38% from the same period of 2006. The

sharp increase is largely attributable to the good sales

performance of the new automatic version of the Quattroporte

launched in January, which is selling well on all

markets. A total of 1,841 units were delivered to the dealer

network, 38.2% more than in Q1 2006. Higher sales volumes

and major cost efficiency gains brought the trading result

near to break even, representing a major improvement from

the 19 million trading loss reported in Q1 2006. The new

Maserati Granturismo, expected to reach markets in Q3 2007,

was presented at the Geneva Motor Show in March. Ferrari had

revenues of 381 million. The 20.2% increase from the same

period of 2006 is attributable to strong sales of the 599

GTB Fiorano and of the coupι, spider and challenge versions

of the F430. During Q1 2007, deliveries to the sales network

totalled 1,596 units, up 26.1% from Q1 2006. Ferrari closed

the first three months of 2007 with a trading profit of 31

million, posting a strong improvement (+20 million) on Q1

2006. This positive change is mainly attributable to higher

sales volumes and efficiency gains across the organization.

Agricultural and Construction Equipment

CNH Case New Holland revenues in Q1 2007 amounted to 2.7

billion, an increase of 1.5% over Q1 2006 (+10.6% on a US

dollar basis). This increase is due to the combined impact

of lower volumes more than offset by a much better mix,

primarily due to increased sales of higher horsepower

agricultural tractors and combines, and improved pricing in

both the agricultural and construction equipment segments.

The global market for agricultural equipment decreased by 4%

compared to Q1 2006.

|

|

|

All major businesses contributed to the improvement:

the Automobiles businesses result more than

quadrupled to 222 million (173 million better than

2006), Iveco (trucks) more than doubled its

performance, up 80 million to 150 million, while

the Agricultural and Construction Equipment business

improved 52 million to 189 million (+50% in US

dollar terms). |

|

|

|

|

On revenues of 13.7 billion in the first quarter of

2007, up 8.9% from 2006, Fiat Group posted the 9th

consecutive quarterly year-over-year improvement in

trading profit (IFRS based), up 84% to 595 million. |

|

|

Demand rose by 1% in North America with higher sales of

tractors and combine harvesters. In Latin America, the

market increased significantly, in both combines and

tractors. The market for combine harvesters was down

slightly in Western Europe while it increased slightly for

tractors. In the rest of world countries market was down

despite strong demand for combine harvesters. The global

construction equipment market grew by 10% in comparison with

Q1 2006. Demand for both heavy and light equipment grew

sharply in all geographic regions except North America,

which reported a significant decline (-14%). CNH unit

deliveries of tractors across all horsepower classes

declined by 7% with respect to Q1 2006, although in the 40+

horsepower range (which represent the core of CNHs

agricultural activities), volumes were down only 2.6%. These

results were wholly attributable to the combined effect of

destocking efforts and a shift in commercial emphasis

towards higher horsepower equipment. More significantly,

both Case IH and New Holland increased retail penetration,

with market share gains in North America and Europe. Overall

deliveries of combine harvesters were up sharply (+10%)

reflecting strong demand in Latin America and Rest of World,

more than offsetting declines in North America and Western

Europe. Also in combines, Case IH and New Holland continued

to gain market share in North America, Europe and Latin

America. CNH construction equipment deliveries were

essentially flat compared to Q1 2006, reflecting higher

volume in virtually all markets and a decline, consistent

with overall market performance, in North America.

CNH closed Q1 2007 with a trading profit of 189 million, an

increase of 52 million from Q1 2006 (50% up on a US dollar

basis). The increase in volume/mix and prices in both

equipment segments and production cost efficiency gains

amply compensated for higher costs connected with product

quality improvements and brand-enhancement initiatives. In

Q1 2007, New Holland Agricultural Equipment launched two

important tractor lines in the 100 to 213 hp range, the

T6000 and T7000. Case IH Agricultural Equipment began

shipping the new PUMA tractors and its new Axial-Flow 7010

Combine Harvester. New Holland Construction Equipment and

Case Construction Equipment both launched new Tier 3

emission-compliant products.

Trucks and commercial vehicles

In Q1 2007, Iveco revenues totalled 2.5 billion (+20.1%),

as a result of higher sales volumes and improved pricing.

Western European demand for commercial vehicles (curb weight

≥ 2.8 tons) recorded an overall increase of 6.9% compared

with Q1 2006 (light vehicles +8.8%, heavy vehicles +5.1%,

medium vehicles -7.9%). Demand rose in all major European

countries, with the exception of the UK. Iveco delivered a

total of 47,900 vehicles, up 14.2% from Q1 2006. In Western

Europe a total of 35,700 vehicles were delivered (+9.8%),

with significant improvements in the key European countries:

France (+17.5%), Germany (+16.3%), Italy (+10.8%) and Spain

(+14.0%). The sole exception was UK, where sales were

negatively impacted by a contraction in demand. In the rest

of the world, sales volumes were up significantly in Eastern

Europe (+59%) and Latin America (+42%). Ivecos market share

in Western Europe stood at 10.3%, virtually unchanged from

Q1 2006 (+0.1 percentage point), as market shares improved

in heavy and light-range vehicles but declined in

medium-range vehicles. At the country level, market shares

contracted in Italy and Germany, and posted increases in

Spain, UK and France.

Ivecos trading

profit in Q1 2007 was 150 million (6% of revenues), a sharp

improvement from the 70 million trading profit (3.4% of

revenues) of Q1 2006. The increase was mainly attributable

to higher volumes and better pricing resulting from the

improvement in product value positioning with customers and

the strong performance of heavy vehicles. Iveco Daily, with

26.000 unites sold in the Q1 2007, is outperforming initial

projections. In March, Iveco launched the new Stralis, the

latest evolution of its heavy-range on-road vehicles.

Components and Production Systems

Fiat Powertrain Technologies (FPT) had revenues of 1.7

billion in Q1 2007, up 8.2% from Q1 2006. Sales to Fiat

Group companies accounted for 73% of the total (74% in

2006), with the balance representing sales to third parties

and joint ventures. Revenues of the Passenger & Commercial

Vehicles product line increased by 5.6% to 935 million,

with 74% of production earmarked for Group customers. During

the quarter the Sector sold a total of 634,000 engines

(+4.5%) and 501,000 transmissions (+15.5%). Revenues of the

Industrial & Marine product line amounted to 768 million,

an increase of 10.8% mainly resulting from sales to the Fiat

Group. 125,000 engines were delivered (+5.9%), mainly

earmarked for Iveco and CNH (62% of total) and Sevel, a

joint venture for the production of light commercial

vehicles. 32,000 transmissions (-13.3%) and 77,000 axles

(+15.4%) were also sold. In Q1 2007, Fiat Powertrain

Technologies had a trading profit of 44 million, up from

34 million in Q1 2006. Growth stemmed from higher volumes

and significant cost efficiencies.

In Q1 2007 Magneti Marelli had revenues of 1.2 billion, up

2.7% from Q1 2006. Based on the same scope of activities,

revenues increased by 7.4%, due to higher sales to Fiat

Group Automobiles, the positive performance of the Brazilian

market and increased sales of new applications in the Nafta

area. Trading profit totalled 45 million, up 3 million

from Q1 2006. The improvement was due to higher sales

volumes and streamlining of the cost base, which offset

competitive pressure on sales and higher raw material

prices.

Teksid had revenues of 212 million, down 18.5% from Q1

2006. Excluding the impact of the sale of the Magnesium

Business Unit, the decrease would have amounted to 10% due

to lower sales volumes in North America. Teksid closed the

quarter with a trading profit of 20 million (12 million in

Q1 2006). On a comparable scope of operations the increase

would have amounted to 11 million, mainly due to efficiency

gains.

Comau had revenues of 229 million in Q1 2007, down 25.2%

from Q1 2006. The decrease is attributable to Body-welding

operations in Europe and Powertrain operations in North

America, which are impacted by the structural decline in the

industrys investment levels. Exchange rate trends also

negatively influenced revenue performance. Order intake for

the period totalled 398 million, substantially in line with

Q1 2006. The order backlog at the end of the quarter

totalled 648 million, up 12% from December 31, 2006. In Q1

2007 Comau had a trading loss of 26 million, compared to a

6 million trading loss in Q1 2006. The change is mainly

attributable to the negative performance of Bodywelding

operations in Europe. Starting from the second half of 2006,

the business has undergone an intense reshaping and

restructuring process. Benefits associated with these

efforts will be fully visible in 2008.

Other Businesses

In Q1 2007, Itedi had revenues of 100 million, up 6.4% from

Q1 2006. Higher revenues at Editrice La Stampa and higher

advertising revenues at Publikompass contributed to this

increase. Itedi closed the quarter with a trading profit

substantially at break even, in line with Q1 2006. Higher

marketing costs and the termination of government paper cost

subsidies were offset by better revenue performance and

cost-containment initiatives. As a result of the process of

transformation of services activities and their refocusing

on Fiat customers, starting January 1, 2007 the activities

of the Business Solutions Sector were transferred to Fiat

Services, a company that is reported under Holding companies

and Other companies. Fiat Services provides services

exclusively to the Fiat Group and is organized in three

service units: Transactional Processes (Finance and

Payroll), ICT Services and Customs Services. In the first

quarter of 2007 the trading loss of all remaining

activities, including Holding companies and the impact of

eliminations and consolidation adjustments, increased by 34

million mainly due to lower activities on the High Speed

Railway contract and different scope of operations (disposal

of Banca Unione di Credito) as well as the expensing of

stock option costs.

Significant

Events Occurring in the first months of 2007

On February 1, Fiat Auto adopted a new name, Fiat Group

Automobiles S.p.A., to underscore the international

aspirations of this sector and the change in its corporate

culture. Fiat Group Automobiles is the 100%-owner of four

new companies Fiat Automobiles, Alfa Romeo Automobiles,

Lancia Automobiles, and Fiat Professional (the

new designation for Fiat Light Commercial Vehicles) whose

creation reflects the Groups renewed focus on the brands

and their respective market positioning. The process of

strengthening the Group through targeted international

agreements continued in Q1 2007. On February 14, 2007, Fiat

Group Automobiles and Tata Motors signed an agreement which

calls for a Tata license to build a pick-up vehicle bearing

the Fiat nameplate at Fiat plant in Cσrdoba, Argentina. The

first vehicles will roll off the Cσrdoba assembly lines

during 2008. Annual production is slated at around 20,000

units. Total planned investment in the project is around

US$80million. In February, Iveco and Tata Motors announced

the signing of a Memorandum of Understanding to analyze the

feasibility of cooperation, across markets, in the area of

Commercial Vehicles. The agreement encompasses a number of

potential developments in engineering, manufacturing,

sourcing and distribution of products, aggregates and

components.

2007 Outlook

The sound results of the first quarter provide a solid

foundation for the Groups commitment to growth and margin

expansion over the 2007-10 period. The Group will continue

to deliver sequential improvements year-over-year, and

confirms all of its 2007-10 targets announced last November.

For 2007, the Groups targets are:

Group trading profit between 2.5 and 2.7 billion (4.5%

to 5.1% trading margin);

Net income between 1.6 and 1.8 billion;

Earning per share between 1.25 and 1.40.

The Group is confirming 2007 guidance at the upper end of

the indicated range. In addition, on the basis of strong

industrial cash flow generation in the first quarter, the

Group now expects year-end net industrial debt below 1

billion (excluding the impact of share buy-backs), less than

half the previously announced target of 2 billion. While

working on the achievement of these objectives, the Fiat

Group will continue to implement its strategy of targeted

alliances, in order to optimise capital commitments and

reduce risks.

|

|

|

|