|

Fiat has reached agreement to

purchase the two Turin-based plants belonging to Teksid Aluminium for the

symbolic price of 100 euros. Teksid Aluminium Luxembourg which currently owns

the facilities, which employ 1,000 people, will invest 10 million euros as part

of the agreement. The repurchase of the plants by Fiat, which sold them in 2002,

ensures an uninterrupted supply of components.

TK Aluminum issued

the following statement on Thursday (9th August): Teksid Aluminum Luxembourg S.à

r.l., S.C.A. (the “Company”) announced that, as of 12:00 P.M., New York City

time (5:00 P.M., London time), on Tuesday, August 7, 2007, consents representing

approximately 52% of the €205,598,000 aggregate principal amount of its

outstanding 11⅜% Senior Notes due 2011 (the “Senior Notes”) have been validly

delivered pursuant to its previously announced solicitation of consents pursuant

to a consent solicitation statement, dated as of August 2, 2007, as amended on

August 3, 2007 (the “Statement”), to implement certain proposed amendments (as

described below) to the indenture governing the Senior Notes (the “Indenture”).

Consequently, the Company, the note guarantors and the trustee executed a

supplemental indenture (the “Supplemental Indenture”) on Tuesday, August 7,

2007. Accordingly, the proposed amendments have become operative in accordance

with their terms. The consent solicitation expired on Wednesday, August 8, 2007

at 10:00 A.M., New York City time (3:00 P.M., London time) at which time

consents representing approximately 78% of Senior Notes had been validly

delivered.

The indenture amendments: (i) allow the sale of Teksid Aluminum S.r.l. and,

indirectly, its subsidiary Teksid Aluminum Getti Speciali S.r.l.(together with

Teksid Aluminum S.r.l., the “Fiat Sold Companies”) to Fiat Powertrain

Technologies S.p.A.(the “Fiat Sale”) pursuant to an agreement, dated July 25,

2007, as amended on August 3, 2007 (the “Fiat Sale Agreement”) (as such

agreement may be further amended in accordance with the terms of the Statement);

(ii) allow the repayment or settlement of certain intercompany obligations,

including the obligations owed by the Company and TK Aluminum-Luxembourg Finance

S.à r.l. to the Fiat Sold Companies and the obligations owed by the Fiat Sold

Companies to certain of the Company’s indirect subsidiaries organized under the

laws of France (the “French Entities”); (iii) permit the transfer of the quotas

held by the Company in Teksid Aluminum Getti Speciali S.r.l. to Teksid Aluminum

S.r.l.; (iv) extend the time by which an offer to purchase Senior Notes with the

proceeds of the sales of each of Teksid Aluminum Poland Sp. z o.o.,

|

|

|

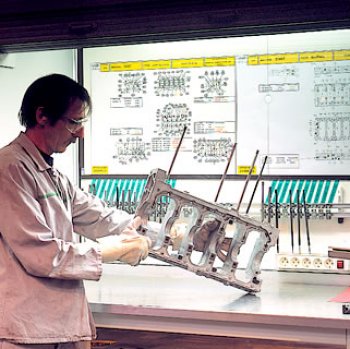

The repurchase of the two Teksid plants by Fiat,

which sold them in 2002, ensures an uninterrupted

supply of components. |

|

|

|

|

Fiat has reached agreement to purchase the two

Turin-based plants belonging to Teksid Aluminium for

the symbolic price of 100 euros. |

|

|

he Company’s indirectly held minority equity interest in

Nanjing Teksid Aluminum Foundry and the Company’s equity

interest in Cevher Dokum Sanayi A.S. is to be made to no

later than October 15, 2007; and (v) extend the time by

which an offer to purchase Senior Notes with the proceeds of

each of the Fiat Payment (as defined in the Indenture) and

the Escrow Amount (as defined in the Indenture) is to be

made to no later than ten (10) business days after receipt

of such payments, but in no event prior to October 15, 2007.

In addition the Company announced today that on August 8,

2007 it completed the Fiat Sale on the previously disclosed

terms set forth in the Statement. Pursuant to the terms of

the Fiat Sale Agreement, Fiat Powertrain purchased the Fiat

Sold Companies for €100, subject to certain conditions,

including a €10 million cash payment from the Company to the

Fiat Sold Companies.

The Company received €13 million of the €18 million Fiat

Payment (as defined in the Indenture). As previously

disclosed, in connection with the Fiat Sale Agreement, the

Company executed an escrow agreement, dated July 25, 2007,

as amended on August 3, 2007 (the “Fiat Escrow Agreement”),

which provides that (i) €2 million of the remaining €5

million of the Fiat Payment shall be held “in escrow” for a

period of up to 18 months from the closing of the Fiat Sale

and in accordance with the terms of the Fiat Sale Agreement

and the Fiat Escrow Agreement and (ii) the remaining €3

million of the Fiat Payment would be paid to the Company at

the closing of the Fiat Sale. The Escrow Fiat Payment may be

released prior to 18 months from the closing date of the

Fiat Sale upon certain events of release. Such events of

release include the date on which all transactions,

receivables and indebtedness between, to or from the Fiat

Sold Companies, on the one hand, and certain of the French

Entities, on the other hand, required to be settled pursuant

to the Fiat Sale Agreement are settled either (x) as set

forth in specific transaction steps attached to the Fiat

Sale Agreement or (y) in cash or by set off based on

principles of applicable law. In connection with the closing

of the Fiat Sale, the remaining €3 million of the Fiat

Payment was paid and the €2 million held in escrow was

released to the Company pursuant to the terms of the Escrow

Agreement.

|

|

|

|