|

|

"Chrysler and

Fiat have become inextricably intertwined,"

Sergio Marchionne, who is now the CEO of

both Fiat and Chrysler, told a key briefing

of analysts and the media yesterday. "The

work that we have done in the last five

months has widened the scope of

cooperation." |

|

|

|

|

|

|

|

|

|

The Fiat 500 will hit the U.S. showrooms

next year and during the five year plan

there will be a gradual roll-out of the

derivatives of the award-winning small car

with the 500C (cabriolet) arriving in 2011

and the high-performance Abarth 500 model a

year later. |

|

|

|

|

|

|

|

|

Doug Betts, Chrysler Group's Head of

Quality, spelled out efforts to improve

Chrysler's dismal quality ratings, saying:

"We are not in denial." Photo: New Dodge

Caliber interior rolled out at the Frankfurt

IAA in September. |

|

|

|

|

|

|

|

|

|

|

|

Chrysler Group has finally outlined its plans to

rebuild itself since emerging from bankruptcy in

the summer, and targeting a doubling of sales

within five years and a profit in two, while at

the end of the plan cycle half of Chrysler's

platforms and engines will be Fiat-sourced.

"Chrysler and Fiat have become inextricably

intertwined," Sergio Marchionne, who is now the

CEO of both Fiat and Chrysler, told a key

briefing of analysts and the media yesterday.

"The work that we have done in the last five

months has widened the scope of cooperation."

Propped up by

US$12.5 billion in loans from the U.S. government the race

is now on to secure a future for Chrysler, and under the

five year plan announced yesterday 21 new models will be

introduced. "The top priority is to invest to create a

compelling brand and product offering," C. Robert Kidder,

Chrysler's chairman told the audience. He added that after

several months of work "the board's confidence that Chrysler

will re-emerge as a strong competitor in the auto market is

considerably stronger." Reaction from analysts to the five

hour long meeting was mixed by Marchionne was upbeat that he

can turnaround Chrysler Group in the way he did for Fiat.

"This is the beginning of a new day," he said.

Fiat is

ambitiously targeting an operating profit break for Chrysler

Group by 2010, increasing steadily to US5 billion, or about

7 percent of net revenues by 2014. With a total operating

profit of US$14 billion over plan period." Marchionne

surprised the audience by saying that Chrysler had generated

US$200 million in operating earnings in the third quarter.

"Some of you have been [assuming] that we are losing money,

this is not true," he said. "Most of you underestimated the

substantial reduction in fixed costs that was carried out by

the old Chrysler. The new Chrysler is being incredibly

parsimonious." He added that Chrysler Group now had US$5.7

billion in cash in hand, up from the US$4 billion it held

when it exited the bankruptcy procedure in June.

The average

variable margin per unit will be stable throughout the plan

with the implementation of "World Class Manufacturing"

techniques and purchasing savings partially offset by price

erosion and negative segment mix. Net income is being

targeted at break-even in 2011, increasing to more than US$3

billion, or 5 percent of net revenues by 2014. Product

spending (R&D and Capex) will average US$4.5 billion per

year for the five years for a total of US$23 billion over

the period (Capex is projected to come in at US$15 billion).

Operating cash flow will become positive from 2011 and is

set to generate over US$15 billion in plan period. Fiat also

says that it will pay back the government TARP and EDC

borrowing by 2014; as well as a Department of Energy

yet-to-be-granted debt of US$2 billion by the end of the

plan cycle. The plan also sees a two-year frame before the

window opens for a flotation of Chrysler. The presentation

stating that the "IPO to be decided by Board of Directors/Members, but highly unlikely to

occur earlier than 2011."

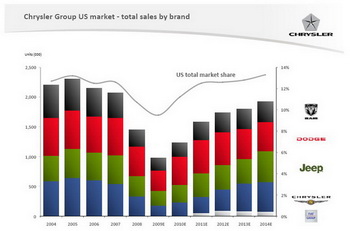

During the five

year plan Fiat is targeting Chrysler Group's combined North

American market share (including the Fiat 500 and its

derivatives set to arrive from 2010) to double from where it

hovers now at under 6 percent to climb to around 13 percent.

This will equate to a more than doubling of volumes from 1.3

million (estimated) this year to a projected 2.8 million in

2014 in a market that Fiat projects will rise to 14.5

million units a year from an estimated 10.5 million units

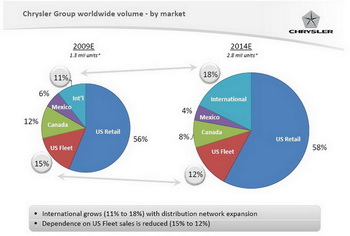

this year. U.S. retail customers, where the highest margins

are available, will account for the bulk of future sales,

Fiat targeting increasing that slightly from 56 to 58

percent of all production while unprofitable fleet sales

will slide from 15 to 12 percent. The overall Canadian and

Mexican market shares' will both decline, from 12 to 8

percent for the former, and 6 to 4 percent for the latter.

International sales will be the biggest focus, climbing from

11 to 18 percent thanks to a clear focus on the Jeep brand.

In volumes terms

in the U.S. this would equate to a climb from 950,000 units

this year, in Canada Chrysler Group would rise from 160,000

to 220,000 units, Mexico 80,000 to 120,000 units and

internationally from 150,000 to half a million. Projected

annual targets for the divisions by 2014 would see Jeep as

the biggest winner with 800,000 units, Dodge and Chrysler on

600,000, Dodge Ram (trucks) on 400,000 and the Fiat 500

topping everything up with 100,000 units a year.

The withdrawal

of the Chrysler and Dodge brands from international markets,

the biggest news to be leaked prior to yesterday's briefing,

was confirmed in by the international presentation slides

given by Mike Manley. Since Dodge was launched in Europe and

Asia three years ago overseas sales for the Chrysler Group

have risen from below 7 percent of production during 2001-06

to a projected 10.7 percent this year, although this is due

to the Group's sales collapsing faster in North American

than outside the region as international sales have

themselves plummeted from 238,000 two years ago to an

estimate of around 144,000 this year. Jeep will be the only

brand to get a full international focus although the new Ram

trucks unit as well as a few models, such as Chrysler's 300

series and Voyager (the overseas name for the Town & Country

minivan) along with Dodge's Journey, could be sold in

selected markets as speciality models on a case-by case

basis.

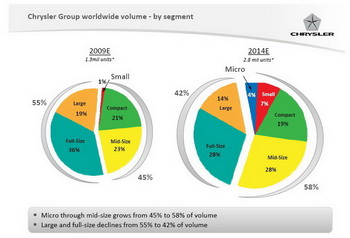

The shift

towards building smaller cars was also emphasised, currently

the "large" and "full size" segments accounts for 19 and 36

percent of sales respectively, this dependence will sharply

reduce to 14 and 28 percent by 2014, meaning that the

segments combined, which currently account for more than

half of all product (55 percent), will shrink their share to

42 percent by the end of the five-year period. Meanwhile

into the void will come mid-size models, they will climb

from 23 to 28 percent to equal the volumes of full-size

cars, compact models will decline slightly from 21 to 19

percent, while small cars will rise from 1 to 7 percent and

micro cars, which are not in the product portfolio at

present, will rise to 4 percent by 2014. By 2014 Fiat

architecture will underpin 44 percent of all platforms while

Chrysler's own platforms (many of which are derived from

Mercedes-Benz technology) will reduce from 100 percent to 56

percent.

According to Paolo

Ferrero, Chrysler Group will see its engine line-up

gradually replaced over the five year plan by Fiat

technology with a particular emphasis on highly efficiency

4-cylinder engines: Fiat's 1.4-litre engine family and

Chrysler's world gas engine, the families being enhanced by

Fiat's new MultiAir technology. The new and more fuel

efficient Pentastar V6 will play a key role under the bonnet

and will also benefit from MultiAir, while advanced new

transmissions will be introduced. 8-cylinder petrol engines

will be the biggest losers under Fiat's tenure and are set

to drop from 18 to 11 percent of production totals, while

6-cylinder engines which are currently under the bonnet of

more than half of Chrysler Group's vehicles (54 percent)

will be dramatically whittled down to 37 percent. Into the

gap will come 4-cylindre petrol engines, they will rise from

19 to 37 percent of the mix. Diesels meanwhile are estimated

to climb from 9 to 14 percent.

Purchasing chief

Dan Knott said that around US$2.9 billion in costs saving

are being targeted from joint purchasing which will include

tie-ins with Fiat Group's CNH agricultural-and-construction

division. Doug Betts, head of Quality, spelled out efforts

to improve Chrysler's dismal ratings, saying: "We are not in

denial."

The Fiat 500

will hit the U.S. showrooms next year and during the five

year plan there will be a gradual roll-out of the

derivatives of the award-winning small car with the 500C

(cabriolet) arriving in 2011 and the high-performance Abarth

500 model a year later. Meanwhile the Alfa Romeo brand

wasn't given a look in at the presentation and will be

treated separately.

|