|

|

During the Fiat Group Investor Day held in

Turin yesterday ambitious plans for the

carmaker's rapid expansion in three key

global growth markets - China, Russia and

India - were outlined. |

|

|

|

|

|

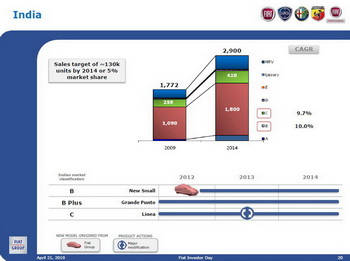

Fiat is targeting Indian increasing sales to

140,000 units per year by 2014 which will

equate to an estimated 5 percent market

share through production of three

high-volume models. |

|

|

|

|

|

|

|

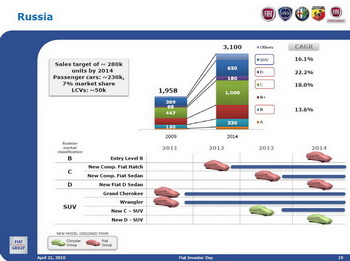

In Russia a global alliance has been

established with Sollers through a 50-50 JV

for production and distribution of

passengers cars and SUVs branded by Fiat and

Chrysler Group with a production capacity

targeted at 300,000 units per year. |

|

|

|

|

|

|

|

Maximum plant capacity will be 330,000

vehicles per annum once the new facility is

fully up to speed which is targeted for

2014, the last year of the 5-year business

plan (which would equate to an estimated 2

percent market share). |

|

|

|

|

|

During the Fiat Group Investor Day

held in Turin yesterday, ambitious plans for its rapid

expansion in three key global growth markets, China,

Russia and India, were outlined. Fiat has been a

latecomer to exploiting new high-growth markets around

the world, but with joint ventures now in place in these

three countries, Fiat believes it is in a perfect place

to catch up.

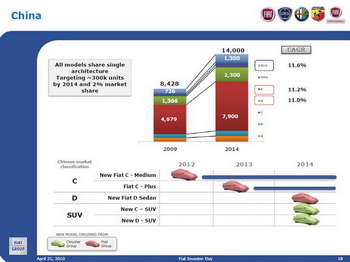

China is the world’s biggest car

market in terms of volume and year-on-year growth, and

presently Fiat is only involved in terms of a small

trickle of imported models. After almost a decade of

being involved in a joint venture with Nanjing Auto and

a catalogue of misjudgements from Fiat, earlier this

year – after spending sometime casting round for a new

partner – signed a 50-50 joint venture with Guangzhou

Automobile Group (GAC) for production of cars and

engines.

Maximum plant capacity will be 330,000 vehicles per annum once the new

facility is fully up to speed – a goal targeted for

2014, the last year of the 5-year business plan (which

would equate to an estimated two per cent market share).

Fiat plans to roll five cars out of the factory by that

time, starting with its new C-segment sedan in 2012,

which will be the first car to come off the new lines.

In 2013 it will add a second model, dubbed "C-segment Plus". Chinese

buyers are rapidly moving upscale and Fiat has

previously tried to create a more luxurious version for

China, using the Siena sedan as a base during its

abortive JV with Nanjing – although the resulting Perla

was swiftly consigned to the footnotes of Fiat history.

In 2014, Fiat also plan a D-segment sedan at the plant

(a rebadged version of the next generation Dodge

Avenger), as well as C- and D-segment SUVs developed by

Chrysler, likely to be sold as Jeeps.

In Russia, a

global alliance has been established with Sollers

through a 50-50 JV for production and distribution of

passenger cars and SUVs, branded by Fiat and Chrysler

Group. This venture has a production capacity targeted

at 300,000 units per year, with a minimum of 10 percent

of produced vehicles to be shipped to export markets.

Sales targets for 2014 will be 280,000 units, with

230,000 of these being passenger cars, adding up to an

estimated seven per cent market share.

Eight vehicles,

split between Fiat and Chrysler Group, are proposed to

be in production by 2014. First up next year will be

Jeep’s Grand Cherokee and Wrangler, which are set to go

into production next year (they are incorrectly marked

on the slides as Fiat-based vehicles; yesterday's

presentations are in fact riddled with mistakes). In

2012, Fiat’s C-segment replacement for the Bravo will be

added to the plant in hatchback format, with a C-segment

sedan coming on stream in Russia a year later.

In 2014, two

further Fiat-badged models will arrive in Russia – the

new cheap B-segment hatchback (Progetto 326), and a new

D-segment sedan (as in China, it will be a rebadged

next-generation Dodge Avenger). Finally, two SUVs on

Chrysler Group platforms are proposed for 2013

(C-segment) and 2014 (D-segment).

The third key

global growth market is India, and here Fiat is building

on the early success of a new 50/50 JV with domestic

giant Tata Motors. This alliance was established in 2007

for the production and sale of Fiat-branded vehicles, as

well as FPT engines and transmissions destined for both

the local market and for export. Current car production

and the Ranjangaon factory in Pune is comprised of the

Palio, Grande Punto and Linea for Fiat, and the Indica

and Manza for Tata, while current powertrain production

comprises of the 1.3 Multijet and Fire 1.2/1.4 and

related transmissions.The Palio

will soon be phased out of production in India, and in

its place in 2012 will come the "New Small" (Progetto

326), to keep production running at three models. The

New Small, Grande Punto and Linea will continue through

2014, with the Linea receiving a facelift in 2013. All

models will also be exported to regional markets and

further afield. Fiat is targeting Indian sales of

140,000 units per year by 2014, which will equate to an

estimated five per cent market share.

|

|

|