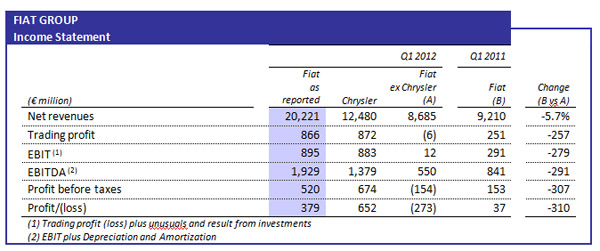

Fiat

Group has posted a mixed result for the first quarter;

its net profit came in at

379 million euros for the first three months but that

was driven almost exclusively by Chrysler Group and if

that is stripped out of the result Fiat slumped to a

loss of 273 million euros. In a conference call Fiat and

Chrysler CEO also said that the much vaunted investment

plans for Italy remained on hold.

Fiat Group

Revenues were

€20.2 billion for the quarter. Excluding Chrysler, net

revenues were €8.7 billion, a 5.7% decrease compared to

Q1 2011 mainly reflecting volume declines in Europe,

where trading conditions continued to remain weak for

both passenger cars and light commercial vehicles,

particularly in Italy, with Fiat production and

deliveries being additionally affected by protracted car

hauler strikes. Luxury and Performance Brands increased

revenues by 11.5% to €0.7 billion and Components were

stable at €2.0 billion.

Trading profit for Q1 2012 was €866

million. Excluding Chrysler, trading result was

break-even, compared to a profit of €251 million in Q1

2011. The decline mainly reflects the volume reduction

in Europe and increased pricing pressure in Latin

America and launch costs for new Grand Siena and

Chrysler products, which were only partially compensated

for by industrial efficiencies, further realization of

group synergies, and cost containment actions. For

Luxury and Performance Brands, trading profit increased

14.5% to €71 million and for Components it was in line

with the prior year.

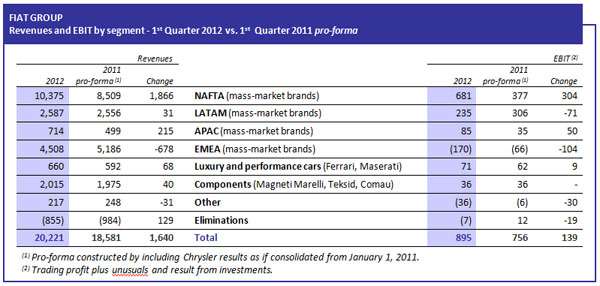

EBIT (Earnings Before Interest and

Taxes, defined as trading result plus unusuals and net

results from investments) was €895 million. Excluding

Chrysler, EBIT was €12 million. On a regional basis for

mass-market brands North America (NAFTA) earnings

increased (on a pro-forma basis) over 80% to €681

million driven by strong volume growth and Asia Pacific

(APAC) earnings grew 143% to €85 million with both

volume and margin improvements. These improvements more

than offset a worsening of losses in Europe, Middle East

and Africa from -€66 million (on a pro-forma basis) to

-€170 million driven by reduced volumes due both to the

continued market contraction and to the car hauler

strike in Italy and a reduction in Latin America

earnings from €306 million (on a pro-forma basis) to

€235 million driven by price pressure from imports by

other carmakers as pre-IPI tax rate increase vehicle

stocks were sold-down and launch costs for the Grand

Siena and Chrysler products.

Net financial expense totaled €375

million. Excluding Chrysler, net financial expense was

€166 million. Net of the result from the

marking-to-market of the Fiat stock option-related

equity swaps (gain of €38 million in Q1 2012 and €23

million in Q1 2011), net financial expense for Fiat

excluding Chrysler, increased by €43 million over Q1

2011 (from €161 million to €204 million), reflecting

higher debt levels.

Profit before taxes was €520

million. Excluding Chrysler, the result before taxes was

a loss of €154 million, with a worsening of €307 million

over Q1 2011 due to a €279 million reduction in EBIT and

a €28 million increase in net financial charges.

Income taxes totaled €141 million.

Excluding Chrysler, income taxes were €119 million and

related primarily to taxable income of companies

operating outside Italy and employment-related taxes in

Italy.

Net profit was €379 million for the

quarter, with Fiat excluding Chrysler reporting a loss

of €273 million.

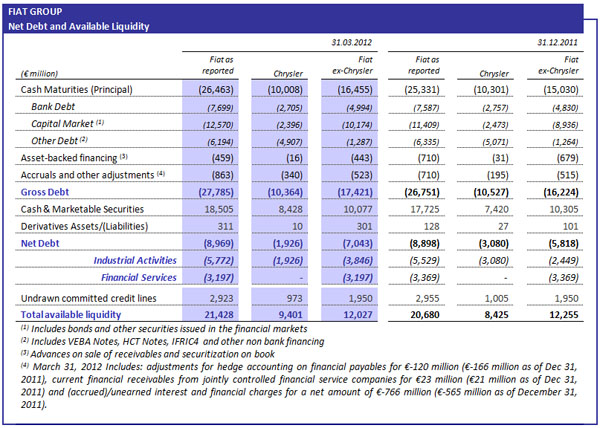

Net industrial debt at 31 March 2012

was €5.8 billion. For Fiat excluding Chrysler it was

€3.8 billion, with the €1.4 billion increase over

year-end 2011 (€2.4 billion) reflecting the impact on

working capital of trading conditions in Europe and

increased capital expenditure. Capex totaled €1.6

billion for the quarter, €0.6 billion of which relates

to Fiat excluding Chrysler.

Total available liquidity, inclusive

of undrawn committed credit lines of €2.9 billion,

improved to €21.4 billion (€20.7 billion at year-end

2011), of which €12 billion related to Fiat excluding

Chrysler and €9.4 billion to Chrysler. The €1.2 billion

in bonds issued during the quarter represent more than

80% coverage of bond maturities in 2012, which relate to

Fiat excluding Chrysler.

New segment information

As a result of the acquisition of the majority

ownership of Chrysler Group and consistent with the

objective of enhancing the operational integration of

Fiat and Chrysler, and as already announced, Fiat has

undertaken significant organizational changes that

became effective September 1, 2011. The new organization

of the Mass-market Brands is based on four Operating

Regions (the “Regions”) that deal with the development,

production and sale of “mass-market brand” passenger

cars, light commercial vehicles and related parts and

services in specific geographical areas: NAFTA (U.S.,

Canada and Mexico), LATAM (South and Central America,

excluding Mexico), APAC (Asia and Pacific countries) and

EMEA (Europe, Middle East and Africa). In addition,

there are two further Operating Segments, the first

which designs, manufactures and sells luxury and

performance cars (Ferrari and Maserati) and the other

that produces and sells components and production

systems for the automotive industry (Magneti Marelli,

Teksid and Comau). Both segments operate on a worldwide

basis.

Under the Group’s new organization, these Regions and

Operating segments reflect the elements of the Group

that are regularly reviewed by the Group’s Chief

Executive Officer together with the Group Executive

Council for making strategic decisions, allocating

resources and assessing performance. The Group Executive

Council was formed on September 1, 2011 and includes the

senior operating and corporate leadership of Fiat and

Chrysler.

Based on the new structure of the Group, beginning

with the first quarter of 2012, the operations of the

Mass-market brands, which were previously reported under

the sectors Fiat Group Automobiles, Fiat Powertrain and

Chrysler, are now attributed to the four Regions as

described above. The Luxury and Performance Brands, as

well as the Components and Production Systems sectors

are reported under two groupings based on their

similarities and relative size. The figures for the

first quarter of 2011 presented for comparative purposes

have been restated accordingly.

Results by segment

MASS-MARKET BRANDS

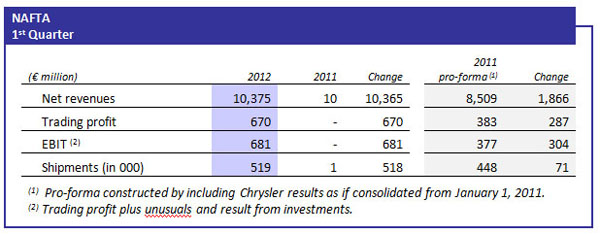

North America (NAFTA)

Vehicle shipments in NAFTA totaled 519,000 units for

Q1 2012, representing a 16% increase over Q1 2011. In

the U.S., vehicle shipments were 418,000 (up 19% over Q1

2011), in Canada 75,000 (up 12%) and 26,000 in other

markets (mainly Mexico).

Vehicle sales

in the NAFTA region totaled 475,000 for the quarter, an

increase of 33% over Q1 2011. Sales increased 39% in the

U.S. to 398,000 and 12% in Canada to 56,000,

significantly outpacing market growth in both countries.

In the U.S., the Group has recorded 24 consecutive

months of year-over-year sales gains. In Canada, for the

first time in its history, Chrysler Group was the

quarterly market leader with a share of 15.0%.

The

U.S. vehicle market closed Q1

2012 up 14% to 3.5 million vehicles. Overall market

share was 11.2% in Q1 2012, compared to 9.2% in Q1 2011.

Jeep vehicle sales totaled 114,000 for the quarter, up

35% year-over-year, with all models contributing to the

increase. Dodge, the Group’s number one selling brand,

posted vehicle sales of 126,000 during Q1 2012, up 24%

from the prior year mainly driven by the Charger (+57%),

the Journey (+28%) and the Durango (+33%). The Ram truck

brand posted a sales increase of 22% to 70,000 vehicles,

reflecting share gains across the Ram pickup range

(light-duty, heavy-duty and cab-chassis). Chrysler brand

sales totaled 79,000 vehicles during Q1 2012, an

increase of 85% over the prior year with strong

performance from the Chrysler 300 and 200.

The

Canadian vehicle market grew 9%

year-over-year to 371,000 vehicles. Chrysler Group’s

total market share was up 0.3 percentage points over Q1

2011 to 15%. Key performers included the Chrysler 200

and 300, the Dodge Charger, the Jeep Wrangler and the

Ram Pickup.

Fiat branded U.S. and Canada sales, consisting of the

Fiat 500 and Fiat 500 Cabrio, were 11,000 vehicles for

the quarter compared to 1,000 vehicles sold in Q1 2011.

The NAFTA region reported

revenues

of €10.4 billion, up 22% (+17% in USD terms) over the

prior year on a pro-forma basis on the back of higher

volumes.

Trading profit for Q1 2012 was up

75% over the prior year to €670 million, with volume

increases being partially offset by higher R&D

expenditure and product content enhancements.

EBIT was €681 million, reflecting the strong

trading profit performance for the period.

The Group announced the addition of a third crew at

both the Jefferson North (Michigan) and Belvidere

(Illinois) assembly plants, where the Jeep Grand

Cherokee/Dodge Durango and new Dodge Dart are built,

respectively. The Dart was included in Kelley Blue

Book’s list of Top 10 Cars of the 2012 Detroit Auto

Show and also won the Autoweek Editors’ Choice

Award as the “Most Significant Vehicle” of the show. The

U.S. National Highway Traffic Safety Administration

awarded the 2012 Chrysler 300 and Dodge Charger 5-star

vehicle safety scores and the Chrysler 300 was one of

the kbb.com’s “10 Best Family Cars of 2012”.

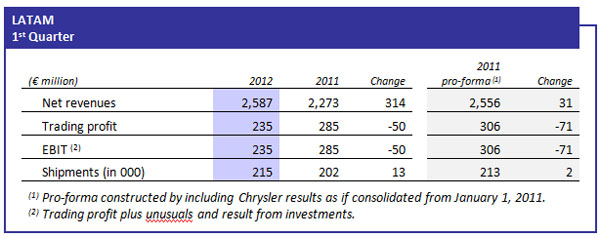

Latin America (LATAM)

In Q1 2012, shipments in the region increased

slightly over the prior year (on a pro-forma basis) to a

total of 215,000 vehicles.

In

Brazil, the passenger car and

light commercial vehicle market was down 0.7% over the

prior year to 773,000 units. The Group strengthened its leadership of the

Brazilian market, with an overall share of 22.7%, up 0.4

p.p. over Q1 2011 and 2.0 p.p. above the nearest

competitor. The Group’s best-selling products continued

to perform well with a 58% share of the A/B segment,

driven by the continuing success of the Novo Uno, the

segment leader, and a 3.6 p.p. share gain for the

recently launched Palio. The 500 gained 1.3 p.p. in the

segment. In addition, the Freemont was the third

best-selling vehicle in the SUV segment.

In Q1 2012, the Group shipped a total of 177,000

passenger cars and light commercial vehicles in Brazil,

representing a 2.1% decline over Q1 2011 (on a pro-forma

basis). Shipments of Chrysler brands in Brazil more than

doubled in Q1 2012 to 2,300 units driven by new product

launches, such as: the new Jeep Wrangler 3.6, the

Chrysler 300C, RAM and Jeep Compass. Fiat launched the

new Grand Siena in the Brazilian market with a favorable

acceptance from automotive press and customers.

In

Argentina where the market was up

9.4% to 243,000 units, the Group increased sales by

approximately 5,000 units, gaining nearly 1.1 p.p. in

share to 12.1% on the back of robust performance in the

LCV segment. In the A/B segment, share was 14.1%, with

the Novo Uno recording significant quarter-over-quarter

growth since launch (+67% vs. Q1 2011). The Fiat Strada

consolidated leadership in its segment, with share up

19.2 p.p. to 59.3%.

Shipments in Argentina were 25,000, up 17.4% over the

prior year on a pro-forma basis, while the total for

other LATAM countries was more than 12,000 units

(+24.1%).

The LATAM region reported

revenues

of €2.6 billion, in line with Q1 2011 on a pro-forma

basis, reflecting the volume trend.

Trading profit for the Region was in

line with internal expectations at €235 million,

compared to €306 million for Q1 2011 (on a pro-forma

basis). Reduction in trading profit was driven by price

pressure from imports by other carmakers as pre-IPI tax

stocks were sold-down and increased advertising spend on

launch of Grand Siena and Chrysler products.

EBIT reflected the trading profit performance

for the period.

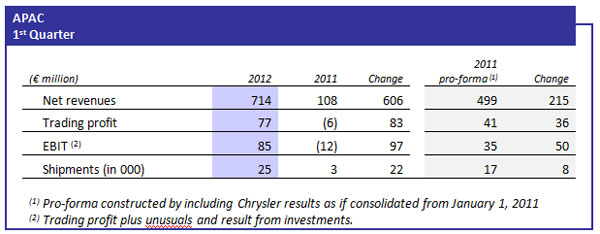

Asia Pacific (APAC)

Vehicle shipments in the region totaled approximately

25,000 units for Q1 2012, up 47% from a year ago (on a

pro-forma basis).

Regional demand rose over last year largely led by

the recovery in Japan and growth in the India and

Australia markets. China and South Korea slowed versus

the prior year.

Group retail sales, including JV, totaled 27,000

units for Q1 2012, up 29% over Q1 2011, driven by strong

performance in China (+28%), Australia (+48%) and Japan

(54%). Top-selling nameplates were the Jeep Compass,

Grand Cherokee, Wrangler, Patriot and Fiat Punto. The

Jeep brand accounted for 63% of APAC sales, more than

doubling in volume compared to Q1 2011.

APAC had

revenues of €714 million,

up 43% over Q1 2011 (€499 million for Q1 2011 on a

pro-forma basis).

Trading profit was €77 million up

nearly 90% compared to €41 million for Q1 2011 on a

pro-forma basis and EBIT, which also

reflects the contribution from joint ventures, was €85

million for the quarter, up over 140% on prior year.

The GAC-Fiat JV is poised to begin production of a

C-segment sedan, the Fiat Viaggio, at the end of the

second quarter and commercial launch is planned for the

second half of 2012. The Viaggio was presented at the

Beijing Auto Show in April and is based on the all-new

Dodge Dart which will soon be launched in NAFTA. The

Beijing Auto Show also witnessed the re-launch of the

Chrysler brand, introduction of a Jeep Wrangler Dragon

concept vehicle, as well as the Imperial 300C.

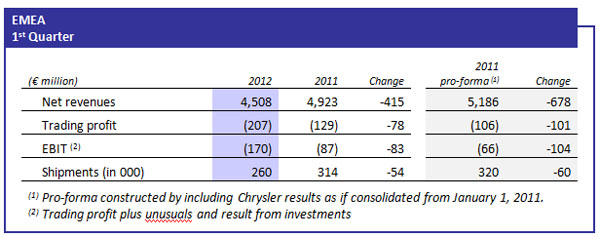

Europe Middle East and Africa (EMEA)

Shipments

of passenger cars and light commercial vehicles (LCV) in

the region totaled 260,000 for the quarter, representing

a decrease of approximately 60,000 units (-18.7%) over

Q1 2011 (pro-forma). Passenger car shipments totaled

212,000, down 18.8% year-over-year, while a total of

48,100 LCVs were shipped, representing a 19.0% decrease

year-over-year. The reduction in both segments was

primarily attributable to performance in Italy.

In

Europe (EU27+EFTA), the

passenger car market was down 7.3% overall to

3.4 million vehicles, with performance varying

significantly by market. The overall trend for the

quarter was substantially attributable to the decline in

demand in the French market (-21.6%), in comparison to

Q1 2011 which still benefited from the tail of

eco-incentives, and in Italy (-21.0%), where sales

dropped to the lowest March level since 1980. In Italy,

in particular, adverse impacts from economic recession

and increased fuel prices (which, however, benefited the

alternative fuel segment) were further aggravated by the

effects of a car hauler strike which endured up to the

last days of the quarter. In Germany and the UK, demand

was substantially in line with the prior year, while

Spain registered a modest decline (-1.9%). For the rest

of Europe, demand was down 3.3% overall with

particularly significant declines in the Netherlands

(-7.5%) and Belgium (-12.7%). Depressed economic

conditions also continued to drive demand down sharply

in markets such as Portugal (-48.4%) and Greece

(-32.0%).

Fiat and Chrysler brands recorded a 6.3% market share

in Europe for the quarter, a 1 percentage point decline

over Q1 2011, but in line with Q4 2011. Around half that

decline was attributable to the unfavorable market mix,

with Italian market weighting in the European total down

about 2 percentage points. The car hauler strike also

had an impact, reducing sales by an estimated 12,000

units or 0.3 percentage points. In Italy, share was down

1.4 percentage points to 27.9%, although there was

significant growth in the alternative fuel car segment

(CNG and LPG), where Fiat increased its leadership

position. By major market, share was higher in the UK

(3.1%), flat in Germany (2.9%) and Spain (3.4%), and

down in France (3.5%), although up slightly over Q4

2011.

For passenger cars, Group shipments in Germany, the

UK and Spain were essentially in line with the prior

year. The general decline in demand coupled with the car

hauler strikes in March resulted in sharp volume

declines in Italy (-34,000 units or 24.3%) and France

(-7,300 units or 33.7%), with the strikes accounting for

a decrease of around 17,500 units across Europe.

The European

light commercial vehicle market

was down 9.1% over Q1 2011 to 417,000 units, with

performance for this segment also heavily affected by

the sharp decline in demand in Italy (-36.4%).

Fiat Professional closed the quarter with an 11.2%

share,

representing a 1.5 percentage point decline over Q1 2011

that was attributable in large part (-1.2 p.p.) to the

unfavorable market mix. Excluding Italy, share of the

European LCV market was 8.7%, representing a 0.1

percentage point increase over the prior year. In Italy,

share was at 42.3% compared to 46.9% in Q1 2011 which

benefited from significant fleet contracts.

In Europe, the Group shipped a total of 45,400 LCVs

during the quarter, a 20.1% decrease over the same

period in 2011. The overall reduction was attributable

to the decline in Italy (-10,000 units or 43.9%, of

which 2,500 units due to the car hauler strike), which

was only partially offset by growth in Germany (+6.1%)

and the UK (+9.2%). Of note for the quarter, was the

Fiat Ducato, one of the best performers in its segment,

with 26,000 units sold and a share stable at 17.8%.

EMEA closed the first quarter with

revenues

of €4,508 million, down 13.1% over the same period in

2011 on a pro-forma basis. The decrease attributable to

volume declines was only partially compensated for by

the success of the rejuvenated Jeep range and the Fiat

Freemont.

In Q1 2012, there was a

trading loss

of €207 million (loss of €106 million in Q1 2011, on a

pro-forma basis), with the impact of volume declines

only partially offset by industrial efficiencies,

further enhanced by group synergies in purchasing and

WCM, in addition to cost containment actions.

EBIT was negative at €170 million (negative €66

million for Q1 2011, on a pro-forma basis), with the

result from investments contributing €36 million (in

line with Q1 2011).

During the quarter, Fiat presented the 2012 style

refresh for the Punto, which is now also offered with

TwinAir Turbo and MultiJet II engines. In addition, the

AWD version of the Fiat Freemont and the new Fiat Strada

were also introduced.

At the Geneva Motor Show in March, Fiat premiered the

new 500L, which – following on from the release of the

Abarth and Cabrio versions – further expands the 500

range. The model will be introduced in European markets

in the third quarter of 2012, with a selection of

gasoline and diesel engines and equipped with Fiat’s

most advanced technological content.

In March, as further confirmation of Fiat’s strong

commitment to the environment, JATO (the global leader

in automotive intelligence) recognized the Fiat brand,

for the fifth consecutive year, for the lowest CO2

emissions of cars sold in Europe in 2011, with an

average of 118.2 g/km. Fiat was also first in the Group

ranking, with average emissions down 2.6 g/km over the

previous year to 123.3 g/km.

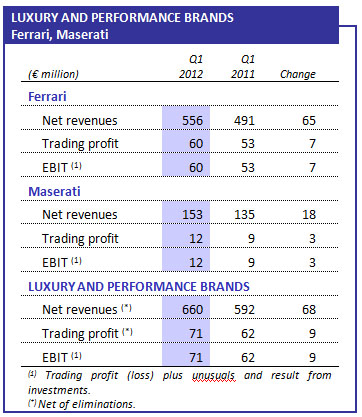

LUXURY AND PERFORMANCE BRANDS

Ferrari

During the first quarter, Ferrari shipped a total of

1,733 street cars, an 11.5% increase over Q1 2011. The

growth was primarily driven by sales of 12-cylinder

models, which were up 74% year-over-year on the back of

the strong performance of the new FF. For 8-cylinder

models, volumes were in line with Q1 2011.

North America remained Ferrari’s no. 1 market with

shipments up 14.4% over the prior year to 452 street

cars. Volumes were also higher in Europe, with 964 cars

shipped (+15.6% over Q1 2011). Strong performance in the

UK, Germany, Switzerland, France and Middle East (+23%

over Q1 2011) more than offset the substantial decline

recorded in Italy. Further growth was achieved in China,

with 154 vehicles shipped (+3% over 2011). In other

markets, performance was substantially in line with the

prior year.

For the first quarter of 2012, Ferrari reported €556

million in revenues, a 13.2% increase

over the same period in 2011 driven primarily by higher

sales volumes.

Ferrari closed the quarter with a

trading

profit and EBIT of €60 million

(€53 million for Q1 2011). The 13.2% increase was

attributable to higher sales volumes and good results

from the personalization program.

During the first quarter, Ferrari presented the F12

Berlinetta, the first of a new generation of 12-cylinder

models. The most powerful vehicle to ever wear the

Ferrari badge, the F12 was the star of the Geneva Motor

Show for both its design and engineering

characteristics. In Geneva, Ferrari also premiered the

new 490 hp California which is 30 kilos lighter than its

predecessor and 30 hp more powerful.

Maserati

Maserati shipped 1,560 cars during the first quarter,

a 6.3% increase over the 1,467 units shipped in Q1 2011.

The significant reduction in volumes experienced in

Europe (-59%) was more than offset by increases in other

markets. In particular, growth was registered in the

United States (+19%), China (+42%), Japan (nearly

triple) and Rest-of-World markets (+30%).

Maserati posted

revenues of €153

million for the quarter, up 13.3% over the same period

in 2011.

The quarter closed with

trading profit

and EBIT of €12 million (trading margin

at 7.8%), an increase of approximately 33% over Q1 2011

on the back of higher volumes and industrial

efficiencies.

At the Geneva Motor Show – five years after launch of

the original model, of which 15,000 units have been sold

– Maserati presented the new GranTurismo Sport. Restyled

both inside and out, performance has also been enhanced

with a more powerful and efficient 4.7 V8 engine that

delivers 460 hp.

Maserati also launched a full-scale development

program, aimed at expanding the sales network by more

than 50% in preparation for launch of the new product

range.

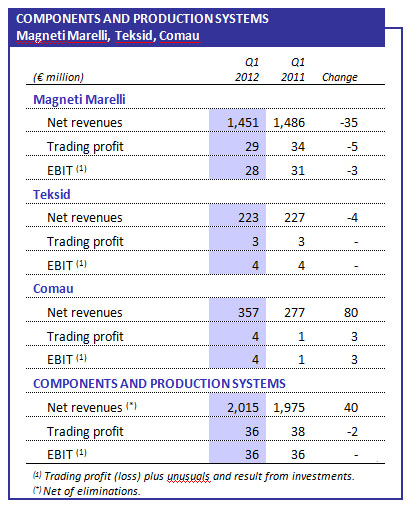

COMPONENTS AND PRODUCTION SYSTEMS

Magneti Marelli

Magneti Marelli businesses reflected the general

trend in their respective markets. Increased levels of

activity were recorded for Lighting, primarily

due to strong demand from German customers and new

technological content of products launched during the

second half of 2011. Electronic Systems

recorded an increase in sales for both telematic and

body products to external customers, compensating for

the contraction in volumes in all product lines in

Italy. The After Market business line also

recorded higher revenues on the back of performance in

Poland and Latin America, as well as the contribution of

new product lines launched in the U.S. beginning in

April 2011. Volumes decreased for the other business

lines mainly due to reduced demand in Italy.

Magneti Marelli reported revenues of €1,451 million

for the quarter, a 2.4% decline over the same period in

2011 (-1.4% at constant exchange rates) in line with the

volume trend. Trading profit for the quarter totaled €29

million, compared to €34 million for Q1 2011. The

decrease was attributable to lower sales volumes,

partially offset by cost containment measures and

efficiency gains achieved during the period.

EBIT totaled €28 million (€31 million for Q1

2011).

Teksid

Teksid reported

revenues of €223

million for the quarter, a 1.8% decline over the first

three months of 2011, attributable to lower volumes for

the Cast Iron business unit (-5.2%) in Europe and the

Americas (with the exception of Mexico) and for the

Aluminum business unit overall (-10.3%).

Teksid closed the quarter with

trading profit

of €3 million and EBIT €4 million, both

in line with Q1 2011.

Comau

Comau reported

revenues

of €357 million for Q1 2012, up 28.9% year-over-year.

The increase was principally attributable to the

Powertrain Systems operations.

Trading profit and

EBIT

were €4 million, compared to €1 million for the

corresponding period in 2011. The increase was mainly

attributable to the Powertrain Systems operations.

Order intake for the period, totaling €635 million,

represented a 6% decrease over the first quarter of

2011. The reduction was primarily attributable to a

decrease for the Powertrain Systems operations,

following particularly high order volumes in 2011. At 31

March 2012, the order backlog totaled €950 million, a

13% increase over year-end 2011.

Significant Events

- In January 2012, Fiat announced that the

“Ecological Event” (3rd performance event

established in the Amended and Restated LLC

Operating Agreement) had been achieved, leading to a

further 5% increase of its interest in Chrysler.

Fiat currently has a 58.5% ownership interest in

Chrysler. The VEBA Trust owns the remaining 41.5%.

- On January 18th, Fiat and Suzuki Motor

Corporation reached an agreement for the supply of a

75 hp 1.3 MultiJet BS-IV Small Diesel Engine – to be

produced under license by Fiat India Automobiles

Limited, a joint venture between Fiat and Tata

Motors – to Suzuki’s affiliate company Maruti Suzuki

India Limited (MSIL).

- On February 1st, during a meeting

with the trade unions that signed the company

specific collective labour agreement, Fiat’s CEO

confirmed that investments for the Mirafiori plant

in Turin would go ahead. Plans call for production

of at least two new models for the export market,

with production to reach 280,000 vehicles per year.

Investment is to commence in the second quarter of

2012 and retooling of the plant will be completed

during 2013. Production of the first model (Fiat

brand) is scheduled to begin in December 2013 and

the second model (Jeep brand) is slated for

production beginning in the second quarter of 2014.

Fiat also confirmed that Mirafiori would continue

production of the Alfa Romeo MiTo, for which a

refresh is planned, as well as the Lancia Musa for a

limited time, on the basis of market demand.

- At the end of February, Fiat signed a Letter of

Intent with Sberbank in relation to a new project

for the production and distribution of passenger and

commercial vehicles in Russia. The Russian bank

intends to finance the project and also take a

minority equity interest of up to 20% in the joint

venture. The product range is expected to be based

on Jeep vehicles and could subsequently be expanded

to include other models and engines which will be

produced and assembled locally.

- During the quarter Fiat completed two bond

issues, one on March 7th for CHF 425 million (fixed

coupon 5.00%, due September 2015) and another on

March 23rd for €850 million (fixed coupon 7.00%, due

March 2017). The notes, issued by Fiat Finance and

Trade Ltd S.A. - a Group wholly owned subsidiary -

and guaranteed by Fiat S.p.A. under the Global

Medium Term Note program, have been rated Ba3 by

Moody’s, BB by Standard & Poor’s and BB by Fitch”.

- On April 4th, Fiat S.p.A. Shareholders approved

the 2011 Financial Statements and a gross dividend

of €0.217 per preference and savings share.

Shareholders also elected the 2012-2014 Boards of

Directors and Statutory Auditors, approved the

Compensation Policy and Incentive Plan and renewed

share buy-back authorization for €1.2 billion,

including the €259 million in own shares already

held. The mandatory conversion of preference and

savings shares into ordinary shares was approved at

the extraordinary session of the General Meeting.

- In April, Chrysler Group gave notice to Ally

Financial, Inc. (Ally) that it will not renew its

current “Auto Finance Operating Agreement” following

the April 30, 2013, expiration. Under the agreement,

Chrysler Group was obliged to give Ally at least

twelve months’ advance notice that it did not intend

to renew the agreement. Chrysler Group is in

discussions with Ally and other financial

institutions regarding various options to meet the

financing needs of Chrysler Group dealers and

customers.

2012 Outlook

Fiat remains fully committed to the strategic

direction laid out in the 5-year plans that were

outlined in November 2009 for Chrysler and April 2010

for Fiat.

Having reviewed economic and trading conditions in

the Group’s four operating regions, Fiat confirms the

expectations of performance in North America, Latin

America and Asia-Pacific.

Events of the past 12 months, and more particularly

the last half of 2011, have cast doubt on the volume

assumptions governing the overall market and the Group’s

own development plans for Europe up to the end of 2014.

The level of uncertainty regarding economic activity in

the Euro zone for the foreseeable future has made

specific projections of financial performance

unreliable. As a result, the Group has provided guidance

for 2012 in terms of ranges, from continuing depressed

trading conditions in Europe to a gradual stabilization

and recovery at the very end of 2012.

As a consequence, Fiat’s 2012 full year guidance is

as follows:

- Revenues > €77 billion;

- Trading profit between €3.8 to €4.5 billion;

- Net profit between €1.2 to €1.5 billion;

- Net industrial debt between €5.5 to €6.0

billion.

As events unfold in the next two quarters, the Group

expects to fully articulate the effect of the Euro zone

economic climate on its 2014 plan when releasing Q3 2012

results.

While working on achievement of its financial

targets, Fiat will continue its strategy of targeted

alliances to optimize capital commitments and reduce

risks.